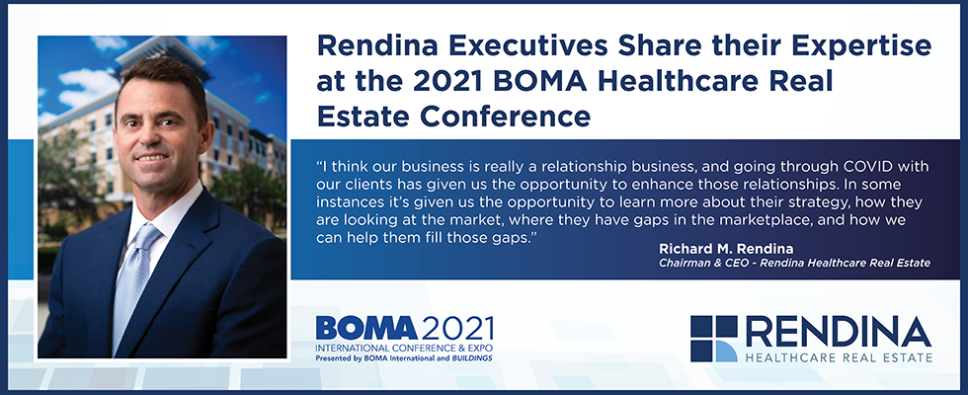

Richard Rendina, Chairman & CEO of Jupiter-based Rendina Healthcare Real Estate, and Steve Barry, President of Rendina, shared their expertise on two educational panels at the 2021 BOMA International’s Medical Office Buildings (MOBs) + Healthcare Real Estate (HRE) Conference Nov. 1-3 in Dallas at the Omni Dallas Hotel.

The importance of relationships and the impact of inflation

“The CEO Perspective” panel discussed a wide range of topics, including the state of the industry, capital market trends, and opportunities and challenges in the dynamic HRE space. The panelists also discussed how the COVID-19 pandemic has impacted the industry.

“I think our business is really a relationship business, and going through COVID with our clients has given us the opportunity to enhance those relationships. In some instances it’s given us the opportunity to learn more about their strategy, how they are looking at the market, where they have gaps in the marketplace, and how we can help them fill those gaps.”

He continued, “I would say it really started with the Affordable Care Act when hospitals were looking to invert their revenue stream to be 60 percent outpatient instead of 60 percent inpatient. Now with COVID, I think they’ve all taken a step back and really want to evaluate their outpatient holdings – where they have offices, where they have ownership. Any opportunities we have to help hospitals and health systems with this is great for us.”

The panel also discussed inflation.

Richard M. Rendina

Chairman & CEO

Inflation is a concern. If it’s going to be in the 3 percent range, who knows what the future holds. Of course we like the fact that we have built-in rent escalators, 2.5-3 percent helps to offset that, but you can’t get the rent growth because it’s usually not short-term. And for your hospital tenants, they love the 15- to 20-year lease because it takes the unpredictability out of inflation. They can underwrite what their cost of doing business is at a medical office building year over year with predictability. They’re not exposed to those things in a lease scenario, and also not exposed to increases in construction costs. I think this is a major component in this, but I also think the amount of capital chasing our industry has a bigger impact on overall returns, and I don’t see that waning; in fact it’s increasing.

The effects of telehealth, COVID and rising development costs

The “Development Trends” panel discussed how the continuous evolution in the HRE industry has been accentuated because of COVID-19 and how health systems and developers are adapting to those changes. One important topic was the increase in telehealth.

Steve Barry

President

“We’ve heard for so long that the virtual visit is going to reduce the healthcare real estate footprint. And in my experience and from what I’m seeing, it almost works a little bit in reverse because this does create a new frictionless access point in the primary care network. And then there are follow-up visits that are required many times. If that person wouldn’t have seen a physician or a PA, the follow-up wouldn’t have taken place. And so, in my experience and talking with providers, it’s net neutral to almost a net positive.”

The panelists also discussed rising costs in the HRE sector.

Mr. Barry said, “We’re seeing increased technology capabilities in buildings, including remote monitoring and virtual technologies. We’re looking at the requirement for more flexible spaces or multi-purpose spaces to be able to accommodate uncertainty in the future. When we list all those things off, I don’t think that’s a less expensive building. I think those are more expensive buildings as opposed to the more straightforward MOB or outpatient facility of the past. So the next question is how we in this current construction environment can deliver these facilities cost efficiently.”